Silver and Gold Prices

- Gold Price Bounced Smartly Up Off the Low

18-Sep-14 Price Change % Change Gold Price, $/oz 1,225.70 -8.70 -0.70% Silver Price, $/oz 18.45 -0.21 -1.13% Gold/Silver Ratio 66.426 0.285 0.43% Silver/Gold Ratio 0.0151 -0.0001 -0.43% Platinum Price 1,351.00 -12.70 -0.93% Palladium Price 831.40 -7.40 -0.88% S&P 500 2,011.36 9.79 0.49% Dow 17,265.99 109.14 0.64% Dow in GOLD $s 291.20 3.88 1.35% Dow in GOLD oz 14.09 0.19 1.35% Dow in SILVER oz 935.72 16.43 1.79% US Dollar Index 84.39 -0.36 -0.42%

3 Day Gold Price Chart

30 Day Gold Price Chart

5 Year Gold Price Chart

3 Day Silver Price Chart

30 Day Silver Price Chart

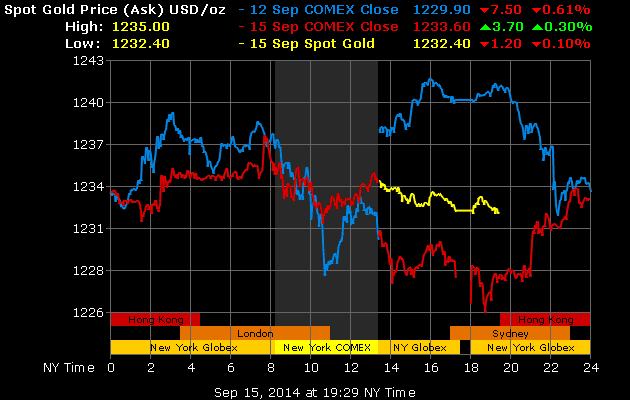

5 Year Silver Price Chart The GOLD PRICE closed Comex $8.70 cheaper at $1,225.70. Silver closed Comex 21.1 cents lighter at $18.452. The GOLD PRICE three day chart shows a bottom yesterday about $1,217 and another today about $1,216. Today the gold price bounced smartly up off that low at 9:30 to its high at noon. Traded above $1,225 rest of the day.Since human beings are social animals on a par with lemmings, it's monumentally tough to run contrary to the herd. However, it's precisely moments like this when most everybody is dead-dog sure things will continue forever that they turn and go the other way. Wouldn't surprise me if gold did that tomorrow.The SILVER PRICE plunge didn't come until today, when it hit a $18.30 low. But that low was a clean V-bottom.Both silver and gold prices are powerfully oversold, but have to snap back hard before anybody but me will pay attention. Silver needs to climb above $18.75 and gold over $1,250. Otherwise the erosion will continue.Call me crazy, but I'll still take gold and silver with 6,000 years to the fiat US dollar's four decades.Continuing our lesson in not panicking today, the markets beat us with a small stick. Stocks rose, still drunk on the FOMC's non-statement, while the dollar index backed off and silver and gold fell.I'm gonna tell y'all one thing: the wonder workers and magicians at the Fed have NOT repealed the law of gravity,. This will end badly for the US dollar and for stocks. The US dollar has been a completely unbacked fiat currency since August 1971; gold and silver have been money since memory runneth not to the contrary. Those who bet against history or gravity lose.

The GOLD PRICE three day chart shows a bottom yesterday about $1,217 and another today about $1,216. Today the gold price bounced smartly up off that low at 9:30 to its high at noon. Traded above $1,225 rest of the day.Since human beings are social animals on a par with lemmings, it's monumentally tough to run contrary to the herd. However, it's precisely moments like this when most everybody is dead-dog sure things will continue forever that they turn and go the other way. Wouldn't surprise me if gold did that tomorrow.The SILVER PRICE plunge didn't come until today, when it hit a $18.30 low. But that low was a clean V-bottom.Both silver and gold prices are powerfully oversold, but have to snap back hard before anybody but me will pay attention. Silver needs to climb above $18.75 and gold over $1,250. Otherwise the erosion will continue.Call me crazy, but I'll still take gold and silver with 6,000 years to the fiat US dollar's four decades.Continuing our lesson in not panicking today, the markets beat us with a small stick. Stocks rose, still drunk on the FOMC's non-statement, while the dollar index backed off and silver and gold fell.I'm gonna tell y'all one thing: the wonder workers and magicians at the Fed have NOT repealed the law of gravity,. This will end badly for the US dollar and for stocks. The US dollar has been a completely unbacked fiat currency since August 1971; gold and silver have been money since memory runneth not to the contrary. Those who bet against history or gravity lose.

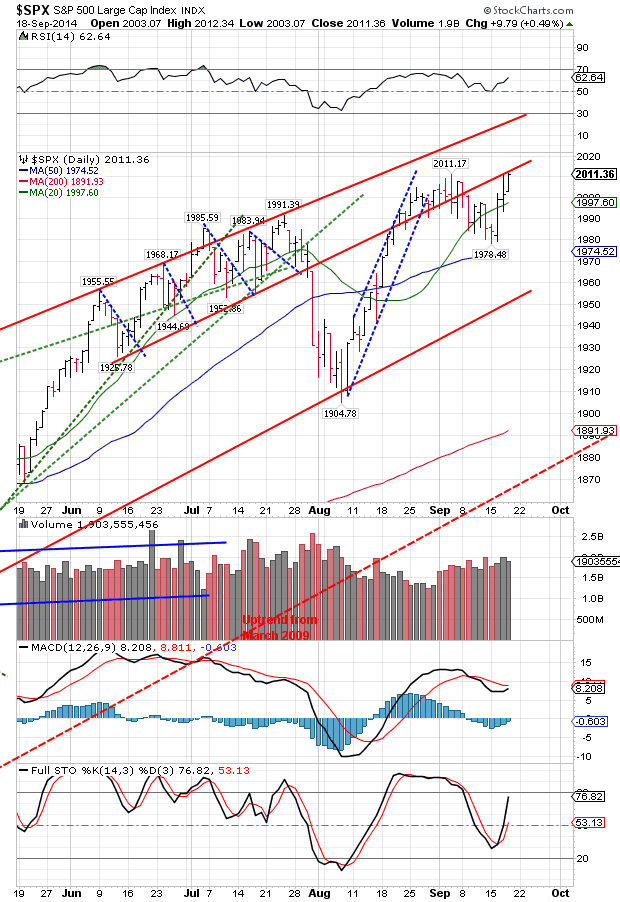

Stocks made new highs today. Dow's last closing high was 17,138 on 16 July. Today it gained 109.14 (0.64%) to 17,265.99. S&P500 also made a new high at 2,011.36, up 9.79 (0.49%). One thing catches my eye. Back in June the S&P500 began trading in a channel, fell out of the channel in July, then traded back up and barely into the channel as September opened, bell down again, and today has traded right up snug against that line, but not above it. Look at it here:

S&P500

Dow in gold rose 0.49% to 14.08 oz (G$291.06 gold dollars) a new high for the move that began just 3 years ago in August 2011, and higher than the December 2013 high at 13.80 oz (G$285.27). Chart:

Dow Jones/ Gold Price

Dow in silver crashed into the overhead resistance line and rose 0.77% to close at 932.29 oz (S$1,205.38). There 'tis -- must turn around from here or rise much higher. Chart:

Dow Jones/ Silver Price US dollar index gave back 36 of the 53 basis points it had gained yesterday, closing at 84.39. That changes nothing, initiates no corrections. Must fall below 84.20 to talk about such things. Remains painfully overbought.Euro rose 0.43% to $1.2919. Yen fell another 0.33% after gapping down. That looks like an exhaustion gap. Closed at 92c/Y100.10 Year Treasury note yield rose 1.12% to 2.629% and nearly touched its 200 DMA above at 2.648%. Odd. Markets really think that Janet Yellum can simply begin raising rates when the Zero Interest Rate Policy is the linchpin of all wickedness the Fed has worked since 2008? Or, maybe they're just computer jockeys following momentum. I'm too big a hick to know the difference.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.- Franklin Sanders, The Moneychanger

The-MoneyChanger.com© 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.WARNING AND DISCLAIMER. Be advised and warned:Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.NOR do I recommend buying gold and silver on margin or with debt.What DO I recommend? Physical gold and silver coins and bars in your own hands.One final warning: NEVER insert a 747 Jumbo Jet up your nose. - The Gold Price was Holding Steady Until the FOMC Report Closing Down at $1,234.40

17-Sep-14 Price Change % Change Gold Price, $/oz 1,234.40 -0.80 -0.06% Silver Price, $/oz 18.66 0.01 0.04% Gold/Silver Ratio 66.142 -0.068 -0.10% Silver/Gold Ratio 0.0151 0.0000 0.10% Platinum Price 1,363.70 -5.10 -0.37% Palladium Price 838.80 -5.40 -0.64% S&P 500 2,001.57 2.59 0.13% Dow 17,156.85 24.88 0.15% Dow in GOLD $s 287.32 0.60 0.21% Dow in GOLD oz 13.90 0.03 0.21% Dow in SILVER oz 919.30 0.99 0.11% US Dollar Index 84.75 0.53 0.63%

3 Day Gold Price Chart

30 Day Gold Price Chart

5 Year Gold Price Chart

3 Day Silver Price Chart

30 Day Silver Price Chart

5 Year Silver Price Chart The GOLD PRICE was holding steady until the FOMC report. It had closed Comex down only 80 cents to $1,234.40, but the announcement took it down another $10. TheSILVER PRICE closed Comex higher by 7/10 cent to $18.663. Here's what's odd. The GOLD/SILVER RATIO closed at 66.142, but in the aftermarket was trading lower, at 65.913. When a panic strikes it usually grips silver fiercer than gold, but not today. Silver's relative strength is a good sign -- no bigger than a cloud the size of a man's hand on the horizon, but a good sign.Gold's break in the aftermarket tugs it down to the low of its recent range and then some. It's lustily oversold, but gives only the merest breath of a hint of turning up in the MACD.In the aftermarket silver lost 10 cents to $18.57, but didn't reach its recent low. Unless both silver and GOLD PRICES come to life tomorrow, then we'll have to endure yet more downside. "Come to life" means close higher, strikingly higher.Easiest thing in the world to do when things go against you is to panic -- throw your hands up in the air, whine and cry, spiral down by lamenting all the stuff you didn't see you should've seen and all the stuff you should have done but didn't do.All that ain't worth spit in the ocean. Worse, it only makes you feel worse and keeps you from taking action. Worse yet, it makes you look like a coward and whiner, and nobody likes those. Besides, I'd hate to admit I'd been whupped by the likes of pudgy Janet Yellum and the socialist apparatchiki at the Federal Reserve.Although for the moment it might seem that way. First thing you do when things go north is look around and ask if you've read them right. It is possible that what you are seeing right this instant is the WASH-OUT in silver and gold and blow-up in stocks and the US dollar. I won't know until we see how markets continue tomorrow.The FOMC's announcement contained no hint of raising interest rates anytime soon, and emphasized that by mumble-mouthing about the labor market.At first stocks foundered on the FOMC announcement, then, reasoning (if they reason) that Zero Interest Rates are good for stocks (they're not), they rose. Dow made a new high close at 17,156.85, up 24.88 or 0.15% but the S&P500 did not make a new high, rising only 2.59 (0.13%) to 2001.57. Both charts show what could be double tops, or a continuation higher.Today took the Dow in silver to 925.15 oz (S$1,196.13 silver dollars) and the upper boundary of that rising wedge. Must stop here if it intends to stop. Dow in Gold broke through the December high (13.80 oz/G$285.28) to end up 1.09% at 14.02 oz (G$289.82).The US dollar index rose 53 basis points to 84.75. Remains fabulously overbought and due for a correction. Maybe tomorrow? FOMC wrecked the yen, down 1.13% to 92.30c/Y100. Euro lost only 0.8% to $1.2859, right at the bottom of its recent range.Most interesting and most paradoxical is the 10 year US treasury note yield ROSE today, by 0.42% to 2.600%. That carries it up into the triangle it broke out of, and above the downtrend's upper boundary. It broke out upside. On news the Fed isn't raising rates any time soon. I can't parse that.

Here's what's odd. The GOLD/SILVER RATIO closed at 66.142, but in the aftermarket was trading lower, at 65.913. When a panic strikes it usually grips silver fiercer than gold, but not today. Silver's relative strength is a good sign -- no bigger than a cloud the size of a man's hand on the horizon, but a good sign.Gold's break in the aftermarket tugs it down to the low of its recent range and then some. It's lustily oversold, but gives only the merest breath of a hint of turning up in the MACD.In the aftermarket silver lost 10 cents to $18.57, but didn't reach its recent low. Unless both silver and GOLD PRICES come to life tomorrow, then we'll have to endure yet more downside. "Come to life" means close higher, strikingly higher.Easiest thing in the world to do when things go against you is to panic -- throw your hands up in the air, whine and cry, spiral down by lamenting all the stuff you didn't see you should've seen and all the stuff you should have done but didn't do.All that ain't worth spit in the ocean. Worse, it only makes you feel worse and keeps you from taking action. Worse yet, it makes you look like a coward and whiner, and nobody likes those. Besides, I'd hate to admit I'd been whupped by the likes of pudgy Janet Yellum and the socialist apparatchiki at the Federal Reserve.Although for the moment it might seem that way. First thing you do when things go north is look around and ask if you've read them right. It is possible that what you are seeing right this instant is the WASH-OUT in silver and gold and blow-up in stocks and the US dollar. I won't know until we see how markets continue tomorrow.The FOMC's announcement contained no hint of raising interest rates anytime soon, and emphasized that by mumble-mouthing about the labor market.At first stocks foundered on the FOMC announcement, then, reasoning (if they reason) that Zero Interest Rates are good for stocks (they're not), they rose. Dow made a new high close at 17,156.85, up 24.88 or 0.15% but the S&P500 did not make a new high, rising only 2.59 (0.13%) to 2001.57. Both charts show what could be double tops, or a continuation higher.Today took the Dow in silver to 925.15 oz (S$1,196.13 silver dollars) and the upper boundary of that rising wedge. Must stop here if it intends to stop. Dow in Gold broke through the December high (13.80 oz/G$285.28) to end up 1.09% at 14.02 oz (G$289.82).The US dollar index rose 53 basis points to 84.75. Remains fabulously overbought and due for a correction. Maybe tomorrow? FOMC wrecked the yen, down 1.13% to 92.30c/Y100. Euro lost only 0.8% to $1.2859, right at the bottom of its recent range.Most interesting and most paradoxical is the 10 year US treasury note yield ROSE today, by 0.42% to 2.600%. That carries it up into the triangle it broke out of, and above the downtrend's upper boundary. It broke out upside. On news the Fed isn't raising rates any time soon. I can't parse that.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.- Franklin Sanders, The Moneychanger

The-MoneyChanger.com© 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.WARNING AND DISCLAIMER. Be advised and warned:Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.NOR do I recommend buying gold and silver on margin or with debt.What DO I recommend? Physical gold and silver coins and bars in your own hands.One final warning: NEVER insert a 747 Jumbo Jet up your nose. - Silver and Gold Prices Gained with the Gold Price Closing at $1,235.20

16-Sep-14 Price Change % Change Gold Price, $/oz 1,235.20 1.60 0.13% Silver Price, $/oz 18.66 0.10 0.54% Gold/Silver Ratio 66.209 -0.271 -0.41% Silver/Gold Ratio 0.0151 0.0001 0.41% Platinum Price 1,368.80 3.80 0.28% Palladium Price 844.20 7.30 0.87% S&P 500 1,998.98 14.85 0.75% Dow 17,131.97 100.83 0.59% Dow in GOLD $s 286.71 1.32 0.46% Dow in GOLD oz 13.87 0.06 0.46% Dow in SILVER oz 918.31 0.48 0.05% US Dollar Index 84.22 -0.15 -0.18%

3 Day Gold Price Chart

30 Day Gold Price Chart

5 Year Gold Price Chart

3 Day Silver Price Chart

30 Day Silver Price Chart

5 Year Silver Price Chart Blasted FOMC meeting has cast its destabilizing pall over all markets. The GOLD PRICE rose $1.60 to $1,235.20 today, the SILVER PRICE gained ten cents to 1865.6c. Both are waiting for the FOMC announcement. Have y'all noticed that throughout the last week's weakness the GOLD/SILVER RATIO has not moved much, staying in the 66+ range. That's positive for both metals, because when they are plunging with determination, that ratio soars.Once again we see the great Federal Reserve which was supposed to stabilize markets only destabilizes markets by its interference. When they make me dictator the first thing I'll do is abolish the Fed. Second thing is pull the funding for NPR. Third thing will be to legalize raw milk and Farm Gate Sales.Now to markets: That "idea" I mentioned yesterday took the form in the stock market today of "Janet Yellum won't change anything tomorrow" which provided an excuse for the market to rise. But in the US dollar index, where the bet has been Mother Yellum would raise interest rates soon, speculators were starting to puke in their waste baskets.Dow today made a new intraday high, but not a new high close. Rose 100.83 (0.6%) to 17,131.97. S&P500 added 14.85 (0.75%) to 1,998.98. That brought the Dow but not the S&P500 back up to the level it had been eroding from for the last two weeks.Dow in Gold hit a new high today at 13.85 oz (G$286.30 gold dollars), higher by half an ounce than the December high. Sho' nuff Fish or Cut Bait Time. Must reverse soon, I'd say tomorrow.Dow in silver rose 0.34% to 915.12 oz (S$1,183.19 silver dollars). Tomorrow would be a good time for the DiS to turn 'round, too.US dollar index gave up 15 basis points (0.17%) to 84.22. Still fighting and fiddling with that 9 year downtrend line. A fall here would not necessarily negate the potential for the dollar to break out later. Disappointing interest rate news out of the FOMC tomorrow will send the dollar skidding. Euro gained 0.15% to $1.2960 while the yen moved up only 0.04% to 93.33.SPECIAL OFFER -- My overstocked KrugerrandsI've bought a lot of South African Krugerrands lately & find myself overstocked, so I'm pricing these to move.South Africa revolutionized the gold coin industry in 1968 when they introduced a gold coin containing exactly one troy ounce of gold -- it made the math easy to figure what it was worth. They have minted these 22 karat (91-2/3% pure) coins in the same weight and fineness ever since. They proved so popular that in 1985 when the US began minting the gold American Eagle, they copied the Krugerrand specifications exactly.I have only Eighty (80) coins to sell. No re-orders at these prices after those are spoken for. Spot gold basis is $1,235.20. OFFER NO. 1Four (4) each South African Krugerrands at $1,272.75 each for a total of $5,091.00 plus $35 shipping for a grand total of $5,126.00. That's a premium of 3.0% over melt value. OFFER NO. 2Five (5) each South African Krugerrands at $1,272.25 each for a total of $6,363.75 plus $35 shipping for a grand total of $6,398.75. That's a premium of 3.0% over melt value. OFFER NO. 3 -- Mix and MatchAny lot of eight (8) or more South African Krugerrands at $1,272.75 each plus $35 per order shipping. Still at a premium of 3%.NOTE: I will charge shipping only once per order no matter how many lots you buy.Special Conditions:First come, first served, and no re-orders at these prices. I will write orders based on the time I receive your email Send email to offers@the-moneychanger.comSorry, we will not take orders for less than the minimum shown above.All sales on a strict "no-nag" basis. We will ship as soon as your check clears, but we allow Two weeks (14 days) for your check to clear. Calls looking for your order two days after we receive your check will be politely and patiently rebuffed.It increases your chances of getting your order filled if you offer me a second choice, e.g., "I want to order Three lots of Offer #3 but if not available will take One lot of Offer #2." ORDERING INSTRUCTIONS:1. You may order by e-mail only to offers@the-moneychanger.com. No phone orders, please. Please do NOT order by replying to THIS email, because it will not reach me timely.Please include your name, shipping address, & phone number in your email. Surprising as it is, we cannot ship to you without your address. Sorry, we cannot ship outside the United States or to Tennessee.Repeat, you must include your complete name, address, and phone number. We will read your mind, but will have to charge you three times the price. Cheaper if you just supply your information so I don't have to read your mind.2. When you buy from us, we cannot later change or cancel the trade. We are giving you our word that we will sell at that price, & you are giving us your word that you will buy at that price, regardless what later happens in the market, up or down.If you break your word to us, we will never again do business with you.3. Orders are on a first-come, first-served basis until supply is exhausted.4. "First come, first-served" means that we will enter the orders in the order that we receive them by e-mail.5. If your order is filled, we will e-mail you a confirmation. If you do not receive a confirmation, your order was not filled.6. You will need to send payment by personal check or bank wire (either one is fine) within 48 hours. It just needs to be in the mail, not in our hands, in 48 hours.7. "No Nag Basis" means that we allow fourteen (14) days for personal checks to clear before we ship.8. Mention goldprice.org in your email.Want your order faster? Send a bank wire, but that's not required. Once we ship, the post office takes four to fourteen days to get the registered mail package to you. All in all, you'll see your order in about one month if you send a check.

Have y'all noticed that throughout the last week's weakness the GOLD/SILVER RATIO has not moved much, staying in the 66+ range. That's positive for both metals, because when they are plunging with determination, that ratio soars.Once again we see the great Federal Reserve which was supposed to stabilize markets only destabilizes markets by its interference. When they make me dictator the first thing I'll do is abolish the Fed. Second thing is pull the funding for NPR. Third thing will be to legalize raw milk and Farm Gate Sales.Now to markets: That "idea" I mentioned yesterday took the form in the stock market today of "Janet Yellum won't change anything tomorrow" which provided an excuse for the market to rise. But in the US dollar index, where the bet has been Mother Yellum would raise interest rates soon, speculators were starting to puke in their waste baskets.Dow today made a new intraday high, but not a new high close. Rose 100.83 (0.6%) to 17,131.97. S&P500 added 14.85 (0.75%) to 1,998.98. That brought the Dow but not the S&P500 back up to the level it had been eroding from for the last two weeks.Dow in Gold hit a new high today at 13.85 oz (G$286.30 gold dollars), higher by half an ounce than the December high. Sho' nuff Fish or Cut Bait Time. Must reverse soon, I'd say tomorrow.Dow in silver rose 0.34% to 915.12 oz (S$1,183.19 silver dollars). Tomorrow would be a good time for the DiS to turn 'round, too.US dollar index gave up 15 basis points (0.17%) to 84.22. Still fighting and fiddling with that 9 year downtrend line. A fall here would not necessarily negate the potential for the dollar to break out later. Disappointing interest rate news out of the FOMC tomorrow will send the dollar skidding. Euro gained 0.15% to $1.2960 while the yen moved up only 0.04% to 93.33.SPECIAL OFFER -- My overstocked KrugerrandsI've bought a lot of South African Krugerrands lately & find myself overstocked, so I'm pricing these to move.South Africa revolutionized the gold coin industry in 1968 when they introduced a gold coin containing exactly one troy ounce of gold -- it made the math easy to figure what it was worth. They have minted these 22 karat (91-2/3% pure) coins in the same weight and fineness ever since. They proved so popular that in 1985 when the US began minting the gold American Eagle, they copied the Krugerrand specifications exactly.I have only Eighty (80) coins to sell. No re-orders at these prices after those are spoken for. Spot gold basis is $1,235.20. OFFER NO. 1Four (4) each South African Krugerrands at $1,272.75 each for a total of $5,091.00 plus $35 shipping for a grand total of $5,126.00. That's a premium of 3.0% over melt value. OFFER NO. 2Five (5) each South African Krugerrands at $1,272.25 each for a total of $6,363.75 plus $35 shipping for a grand total of $6,398.75. That's a premium of 3.0% over melt value. OFFER NO. 3 -- Mix and MatchAny lot of eight (8) or more South African Krugerrands at $1,272.75 each plus $35 per order shipping. Still at a premium of 3%.NOTE: I will charge shipping only once per order no matter how many lots you buy.Special Conditions:First come, first served, and no re-orders at these prices. I will write orders based on the time I receive your email Send email to offers@the-moneychanger.comSorry, we will not take orders for less than the minimum shown above.All sales on a strict "no-nag" basis. We will ship as soon as your check clears, but we allow Two weeks (14 days) for your check to clear. Calls looking for your order two days after we receive your check will be politely and patiently rebuffed.It increases your chances of getting your order filled if you offer me a second choice, e.g., "I want to order Three lots of Offer #3 but if not available will take One lot of Offer #2." ORDERING INSTRUCTIONS:1. You may order by e-mail only to offers@the-moneychanger.com. No phone orders, please. Please do NOT order by replying to THIS email, because it will not reach me timely.Please include your name, shipping address, & phone number in your email. Surprising as it is, we cannot ship to you without your address. Sorry, we cannot ship outside the United States or to Tennessee.Repeat, you must include your complete name, address, and phone number. We will read your mind, but will have to charge you three times the price. Cheaper if you just supply your information so I don't have to read your mind.2. When you buy from us, we cannot later change or cancel the trade. We are giving you our word that we will sell at that price, & you are giving us your word that you will buy at that price, regardless what later happens in the market, up or down.If you break your word to us, we will never again do business with you.3. Orders are on a first-come, first-served basis until supply is exhausted.4. "First come, first-served" means that we will enter the orders in the order that we receive them by e-mail.5. If your order is filled, we will e-mail you a confirmation. If you do not receive a confirmation, your order was not filled.6. You will need to send payment by personal check or bank wire (either one is fine) within 48 hours. It just needs to be in the mail, not in our hands, in 48 hours.7. "No Nag Basis" means that we allow fourteen (14) days for personal checks to clear before we ship.8. Mention goldprice.org in your email.Want your order faster? Send a bank wire, but that's not required. Once we ship, the post office takes four to fourteen days to get the registered mail package to you. All in all, you'll see your order in about one month if you send a check.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.- Franklin Sanders, The Moneychanger

The-MoneyChanger.com© 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.WARNING AND DISCLAIMER. Be advised and warned:Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.NOR do I recommend buying gold and silver on margin or with debt.What DO I recommend? Physical gold and silver coins and bars in your own hands.One final warning: NEVER insert a 747 Jumbo Jet up your nose. - Gold Price Closed at $1233.60 Up $3.70

5-Sep-14 15-Sep-14 Change % Change Gold Price, $/oz. 1,265.80 1,233.60 -32.20 -2.5 Silver Price, $/oz. 19.082 18.556 0.526 -2.8 Gold/Silver Ratio 66.335 66.480 0.145 0.2 Silver/gold ratio 0.0151 0.0150 -0.0000 -0.2 Dow in Gold $ (DIG$) 279.87 285.40 5.53 2.0 Dow in gold ounces 13.54 13.81 0.27 2.0 Dow in Silver ounces 898.09 917.82 19.73 2.2 Dow Industrials 17,137.36 17,031.14 -106.22 -0.6 S&P500 2,006.81 1,984.13 -22.68 -1.1 US dollar index 83.79 84.37 0.58 0.7 Platinum Price 1,412.50 1,365.00 -47.50 -3.4 Palladium Price 891.00 836.90 -54.10 -6.1

3 Day Gold Price Chart

30 Day Gold Price Chart

5 Year Gold Price Chart

3 Day Silver Price Chart

30 Day Silver Price Chart

5 Year Silver Price Chart Over the last week the GOLD PRICE lost 2.5% and silver lost 2.8%. I've seen better weeks, but it wasn't Waterloo and Isandlwana combined. Today the SILVER PRICE gained one cent to $18.556 on Comex; gold gained $3.70 to $1,233.60. Today's $13 range in gold and 13 cent range in silver show how genuinely dead metals are. The flashing US dollar and the hope of higher interest rates has sucked away all interest.Imagine you talked your wife into moving from south Georgia to Florida. Imagine you began with $200 and a shaky transmission. Imagine you reach the Mojave Desert and the transmission blows. That is not the time to turn to your wife and say, "Well, at least we've still go our health!"That's what it feels like for me to say, "Well, at least silver and gold have held up well for all the support they've broken."The GOLD PRICE has reached and breached the June low at $1,240.20, after falling through the since-July trading channel bottom, after falling through the uptrend line from the December lows. I'm sure enough glad we've still got our health.Silver reached a low of $18.45, below the December, May, and June lows but above the June 2013 low at $18.17.Here's what's sorry: the more times a market challenges support, the weaker that support becomes, and the more likely to give. On the other hand, silver is now more oversold than at any time since June 2013. Small signs of life appear in momentum indicators. But it's big brother gold we're looking at. It's oversold, too, but not as severely as in June 2013. Only one indicator, the Full stochastics, hint at an upturn, besides the RSI.Waiting this way for silver and gold to turn around, I am given to meditate on my loyalties and beliefs. Somewhere down around my liver or spleen dwells an abiding and unconquerable mistrust of the yankee government and its central bank and fiat money. I look at them the same way a worm looks at a robin, worm that I am. I don't trust 'em, and I've watched them through the worst financial crisis in the past 80 years do exactly what I expected: print more money.They have only two weapons against that deadly loss of confidence that is a financial panic: blarney and liquidity. Blarney is gussying up Janet Yellum or Ben Bernanke and Warren Buffett and Bernard Obama and putting them on the tube to whisper soothing words to the stampeding masses. Liquidity is printing money.Right now, that BLARNEY is working better than even I, who have an opinion of the American Public's gullibility even lower than PT Barnum, am flabbergasted. It is truly amazing.But I am patient as a rock, calm as a 200 year old oak. Facts eventually avenge themselves. The Gods of the Copybook Headings may take long to wreak their vengeance, as Kipling observed, but their vengeance is sure.But I have strayed to chase rabbits. Point is that an awful lot of folks are long dollars and stocks might be disappointed this week when the FOMC makes its pronouncements. Any words the market interprets as working against raising interest rates soon might just rabbit chop the dollar in the back of the neck, and stocks along with the dollar.This best of all possible worlds for financial confidence feeds the dollar and stocks but starves gold and silver. That's what you've seen in the last week. Let's look closer.The past week stocks rolled over and eroded but crashed not. Dow today gained 43.63 (0.26%) while the S&P500 lost 1.41 (0.7%) to 1,984.13. Nasdaq, N-100, and Russell 2000 all fell as well. Dow and S&P500 have both fallen below their 20 day moving averages. Why do we watch the 20 day moving averages anyway? To alert us when a market's momentum has turned down, when it is trading below the average of the last 20 days. Lo, not far from here (16,913 and 1,973) stand the next tripwires, the 50 day moving averages. Add to that the straining behavior of the last month, eking out new highs by points. Next move here should be down, though few expect it.O merciful heavens! My top target for the Dow in Silver for months has been 912 oz, and the high Friday was 912.33 (S$1,179.58 silver dollars). I won't chortle too loud, since it might rise another 10 oz to the upper trend line, but when you stare at a number that long it does leave a crease in your brain.Meanwhile the Dow in Gold today touched the December high at 13.80 oz (G$285.27 gold dollars). When a market touches a previous high (or low), it is Fish Or Cut Bait time. Either it will accelerate through the high to establish a new uptrend, or fall back and reverse.Both the Dow in Silver and Dow in Gold are way overbought. It could be a disappointment from the FOMC this week would knock the dollar and stocks down and perk up metals. However, a trend in force remains in force until it reverses. Haven't seen any reversal yet.US dollar index gained 58 basis points (0.7%) last week, and today added another 13 basis points (0.15%) to end at 84.37. Shucks, I'm plumb out of similes and metaphors to describe how overbought it is. The dollar index is knocking at the downtrend line from the late-2005 high. This same line also forms the upper boundary of a triangle building since the 2008 low at 71.33. Ridiculous as it sounds, the rough target for a breakout from here would be over 102 for the dollar index.Can that happen? We live in Never-Neverland where anything can happen. Do I expect that? No, it works too hard against too many other things Our Masters are trying to manage.Yen and Euro are both excruciatingly oversold, but can't so much as raise a little finger. Yen rose 01.6% today to 93.31. Euro fell 0.21% to $1.2939. Sure look ripe for some kind of rally.

Today the SILVER PRICE gained one cent to $18.556 on Comex; gold gained $3.70 to $1,233.60. Today's $13 range in gold and 13 cent range in silver show how genuinely dead metals are. The flashing US dollar and the hope of higher interest rates has sucked away all interest.Imagine you talked your wife into moving from south Georgia to Florida. Imagine you began with $200 and a shaky transmission. Imagine you reach the Mojave Desert and the transmission blows. That is not the time to turn to your wife and say, "Well, at least we've still go our health!"That's what it feels like for me to say, "Well, at least silver and gold have held up well for all the support they've broken."The GOLD PRICE has reached and breached the June low at $1,240.20, after falling through the since-July trading channel bottom, after falling through the uptrend line from the December lows. I'm sure enough glad we've still got our health.Silver reached a low of $18.45, below the December, May, and June lows but above the June 2013 low at $18.17.Here's what's sorry: the more times a market challenges support, the weaker that support becomes, and the more likely to give. On the other hand, silver is now more oversold than at any time since June 2013. Small signs of life appear in momentum indicators. But it's big brother gold we're looking at. It's oversold, too, but not as severely as in June 2013. Only one indicator, the Full stochastics, hint at an upturn, besides the RSI.Waiting this way for silver and gold to turn around, I am given to meditate on my loyalties and beliefs. Somewhere down around my liver or spleen dwells an abiding and unconquerable mistrust of the yankee government and its central bank and fiat money. I look at them the same way a worm looks at a robin, worm that I am. I don't trust 'em, and I've watched them through the worst financial crisis in the past 80 years do exactly what I expected: print more money.They have only two weapons against that deadly loss of confidence that is a financial panic: blarney and liquidity. Blarney is gussying up Janet Yellum or Ben Bernanke and Warren Buffett and Bernard Obama and putting them on the tube to whisper soothing words to the stampeding masses. Liquidity is printing money.Right now, that BLARNEY is working better than even I, who have an opinion of the American Public's gullibility even lower than PT Barnum, am flabbergasted. It is truly amazing.But I am patient as a rock, calm as a 200 year old oak. Facts eventually avenge themselves. The Gods of the Copybook Headings may take long to wreak their vengeance, as Kipling observed, but their vengeance is sure.But I have strayed to chase rabbits. Point is that an awful lot of folks are long dollars and stocks might be disappointed this week when the FOMC makes its pronouncements. Any words the market interprets as working against raising interest rates soon might just rabbit chop the dollar in the back of the neck, and stocks along with the dollar.This best of all possible worlds for financial confidence feeds the dollar and stocks but starves gold and silver. That's what you've seen in the last week. Let's look closer.The past week stocks rolled over and eroded but crashed not. Dow today gained 43.63 (0.26%) while the S&P500 lost 1.41 (0.7%) to 1,984.13. Nasdaq, N-100, and Russell 2000 all fell as well. Dow and S&P500 have both fallen below their 20 day moving averages. Why do we watch the 20 day moving averages anyway? To alert us when a market's momentum has turned down, when it is trading below the average of the last 20 days. Lo, not far from here (16,913 and 1,973) stand the next tripwires, the 50 day moving averages. Add to that the straining behavior of the last month, eking out new highs by points. Next move here should be down, though few expect it.O merciful heavens! My top target for the Dow in Silver for months has been 912 oz, and the high Friday was 912.33 (S$1,179.58 silver dollars). I won't chortle too loud, since it might rise another 10 oz to the upper trend line, but when you stare at a number that long it does leave a crease in your brain.Meanwhile the Dow in Gold today touched the December high at 13.80 oz (G$285.27 gold dollars). When a market touches a previous high (or low), it is Fish Or Cut Bait time. Either it will accelerate through the high to establish a new uptrend, or fall back and reverse.Both the Dow in Silver and Dow in Gold are way overbought. It could be a disappointment from the FOMC this week would knock the dollar and stocks down and perk up metals. However, a trend in force remains in force until it reverses. Haven't seen any reversal yet.US dollar index gained 58 basis points (0.7%) last week, and today added another 13 basis points (0.15%) to end at 84.37. Shucks, I'm plumb out of similes and metaphors to describe how overbought it is. The dollar index is knocking at the downtrend line from the late-2005 high. This same line also forms the upper boundary of a triangle building since the 2008 low at 71.33. Ridiculous as it sounds, the rough target for a breakout from here would be over 102 for the dollar index.Can that happen? We live in Never-Neverland where anything can happen. Do I expect that? No, it works too hard against too many other things Our Masters are trying to manage.Yen and Euro are both excruciatingly oversold, but can't so much as raise a little finger. Yen rose 01.6% today to 93.31. Euro fell 0.21% to $1.2939. Sure look ripe for some kind of rally.

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.- Franklin Sanders, The Moneychanger

The-MoneyChanger.com© 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.WARNING AND DISCLAIMER. Be advised and warned:Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.NOR do I recommend buying gold and silver on margin or with debt.What DO I recommend? Physical gold and silver coins and bars in your own hands.One final warning: NEVER insert a 747 Jumbo Jet up your nose. - The Gold Price Closed Down at $1,229.9012-Sep-14

Price Change % Change Gold Price, $/oz 1,229.90 -7.50 -0.61% Silver Price, $/oz 18.55 0.01 0.07% Gold/Silver Ratio 66.32 -0.45 -0.68%

3 Day Gold Price Chart

30 Day Gold Price Chart

3 Day Silver Price Chart

30 Day Silver Price Chart Franklin will be vacationing 8-12 September, and won't be publishing commentary during this time. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.- Franklin Sanders, The Moneychanger

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought.- Franklin Sanders, The Moneychanger

The-MoneyChanger.com© 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down.WARNING AND DISCLAIMER. Be advised and warned:Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures.NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps.NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced.NOR do I recommend buying gold and silver on margin or with debt.What DO I recommend? Physical gold and silver coins and bars in your own hands.One final warning: NEVER insert a 747 Jumbo Jet up your nose.

No hay comentarios:

Publicar un comentario